How Much Does It Cost To Renew Register A Car In Ny

How much does it price to annals a auto in NY? It depends on whether you lot're the vehicle's get-go or 2nd owner. First owners are required past law to fork out MTCD and vehicle plate fee, apart from other charges, at the time of registration. That isn't the example for second owners who can go without paying both.

In that location is similar confusion regarding the payment of sales revenue enhancement. The NY Department of Motor Vehicles states that people who have already paid sales tax at the time of purchase of the vehicle – or those whose cars are exempt, demand not pay it at the time of registration. Others aren't as lucky.

Typical fees when registering a auto in NY

You must pay the following fees at the time of registering your motorcar:

Registration fee

New York charges automobile owners a specific amount to register their vehicles under their name. The registration fees begin at $26 for a machine that weighs under one,650 lbs. Vehicle owners whose motorcar weighs more than 1,650lbs are required to pay $1.5 for every additional 100lbs.

Unlike some states that charge an additional fee for electrical vehicles, NY charges a flat registration fee, whether you intend to register an electric vehicle or i that runs on fossil fuels. However, it does require residents of some counties to pay a supplemental fee at the time of registration.

Vehicle plate fee

You're given three options when applying for car registration in New York. The starting time of them let y'all apply for a new registration likewise as vehicle plates. The second pick is that of applying for the transferring of registration and plates from some other car.

The third choice, meanwhile, lets you apply for transferring vehicle registration but with new number plates. Depending on the choice you're going to select, you'll take to pay a different vehicle plate fee you can calculate by going to this page.

Canton utilize tax

Several counties in the NY state, including New York City, have enacted local laws or ordinances to collect vehicle use taxes. These laws take authorized NY DMV to collect the vehicle use taxation from the residents of the county on behalf of their locality.

Here'due south how much vehicle utilise revenue enhancement you may have to pay:

- For counties inside NY Metropolis: Residents of the Bronx, Kings (Brooklyn), Queens, Richmond (Staten Island), and New York (Manhattan) are required to pay $30 every two years in the form of automobile use tax.

- For counties outside NY City: Their residents are required to pay simply $10 every two years in lieu of car apply tax, as long as their car's weight doesn't exceed 3,500lbs– in which case the vehicle utilise revenue enhancement will be double.

Sales tax

Upon registering your vehicle in New York, yous must either pay its sales tax at the DMV part or requite receipts showing it was already paid. There is a third option for those of you who can bear witness that their vehicle is exempt from sales tax at the time of registration.

The state of New York charges a iv% sales tax for registering a new vehicle. Remember that this judge doesn't include whatever city or county sales taxes that may as well employ. Such taxes could be equally steep every bit four.75%, thereby forcing you to pay 8.75% in lieu of sales revenue enhancement.

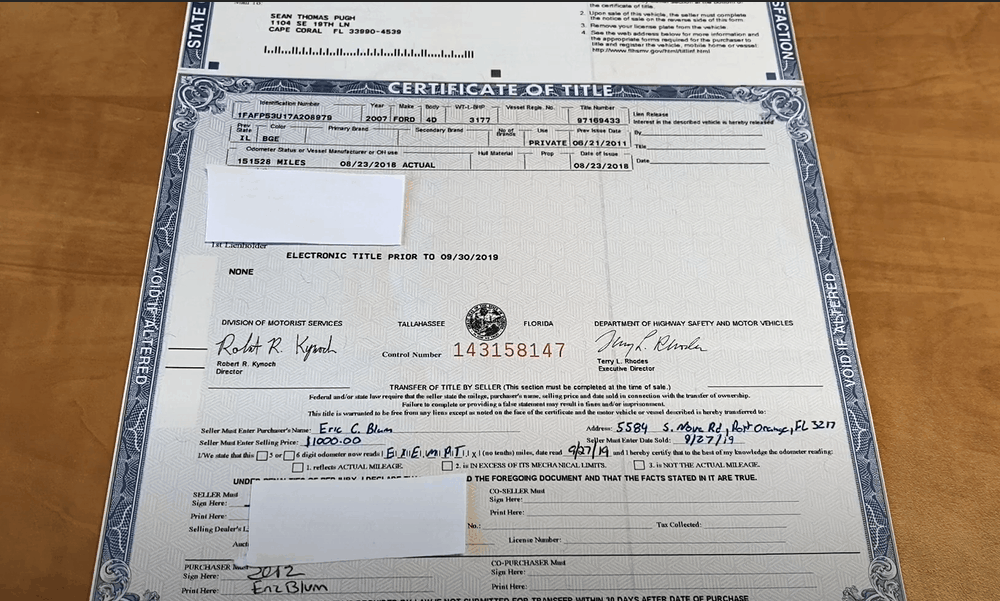

Title certificate fee

About of you lot might already know what the title document is all about. It is a legal document that contains the name of the motorcar'due south owner. Those of you lot who're buying a brand new vehicle will get the title certificate from either the dealership or the DMV. Others will become it from the car's first owner.

The title document as well includes the proper name of 'lienholders'. These are persons who lent the money using which the automobile owner bought the vehicle. The NY DMV states that most motor vehicles of the model yr 1973 and afterwards must be titled, and it charges $50 for a title certificate fee.

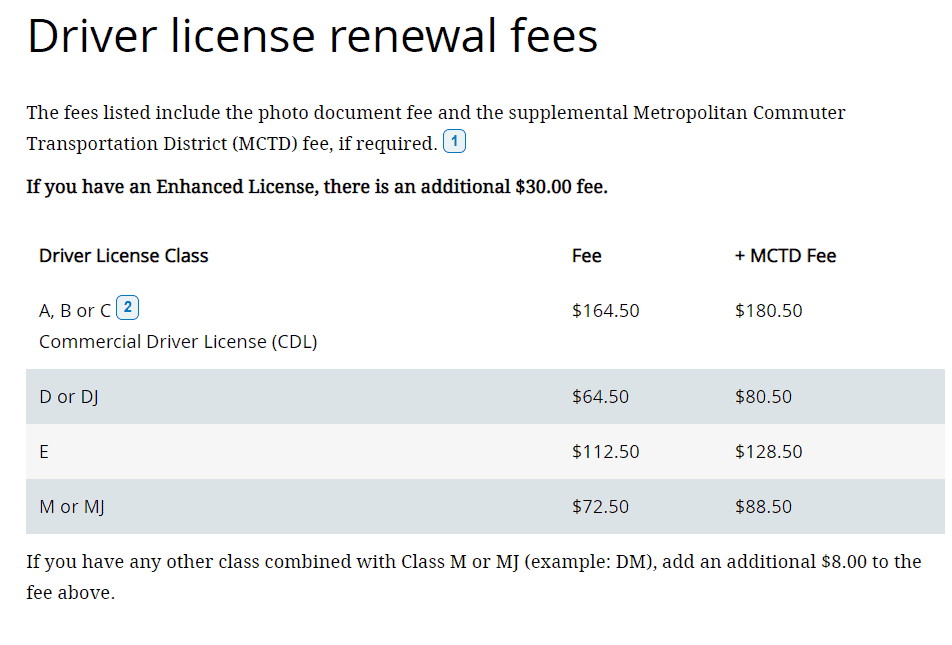

MCTD fee

The New York Department of Motor Vehicles mandate residents of several counties to pay an additional Metropolitan Driver Transportation District (MCTD) fee. The counties include Bronx, New York, Queens, Richmond, Suffolk, Westchester, Putnam, Orange, Nassau, Rockland, and Dutchess.

MTCD fee varies on the length of time your commuter'southward license will be in effect. Car owners whose commuter license will remain valid for less than 8-years will pay $1 in MCTD fee every six months. Those who hold an 8-twelvemonth license fee have to pay $16 at one time at the time of registration of their vehicle.

How much does it cost to annals a car in NY?

Depending on the weight of your vehicle, whether you're its starting time or second owner and other factors mentioned higher up, registering a motorcar in NY might set you back at least $45.fifty in NY. The effigy is reliable, simply yous'd yet do well to check with NY DMV to know the exact amount.

Conclusion

The fact that you lot accept made it this far ways y'all already know how much it costs to annals a car in NY. Various factors contribute to the amount quoted above, including registration fee, vehicle plate fee, canton use tax, sales taxation, title certificate fee, and MCTD fee.

All these factors are so diverse that information technology'south hard to give yous an exact quote of any machine's registration fee in New York. That is why nosotros recommend that y'all check out the land's Department of Motor Vehicle'south website to estimate for yourself how much does it price to register a auto in NY.

Provided you do that, yous won't have to make any terminal-minute arrangements for arranging more money than you carried with yourself to the DMV office. That volition save you a lot of time which you can exploit to drive your car.

Source: https://www.smartmotorist.com/how-much-does-it-cost-to-register-a-car-in-ny

Posted by: hilldiespithe.blogspot.com

0 Response to "How Much Does It Cost To Renew Register A Car In Ny"

Post a Comment